Time in the market is more important than timing the market.

When markets are volatile, either up or down, it’s easy for investors to let emotions like euphoria or fear get the better of them, causing impulsive investment decisions.

Being aware of how emotions can impact decision-making is a significant first step to avoid making poor investment choices when a market decline happens.

If your asset allocation from a week ago made sense, what has changed to make it less appropriate today? Avoiding knee-jerk reactions in these scenarios is usually the prudent course.

Resist The Urge To Sell At The Wrong Time

People have a well-known cognitive bias called “loss aversion.” Put simply, people have a stronger negative reaction to losing money than they do a positive reaction to gaining the same amount.

How does loss aversion play out for variable life insurance policies and investments? It can cause policyholders and investors to sell or reallocate their portfolios when stock prices have already considerably declined.

Use History As Your Guide

Over the past 100 years, the stock market has only performed in two ways: 1) reaching new highs, or 2) decline and recovery.

Knowing how markets have behaved in the past can be a highly effective tool for calming investor emotions or overcoming cognitive bias. Many investors don’t realize how quickly markets tend to bounce back after hitting the bottom.

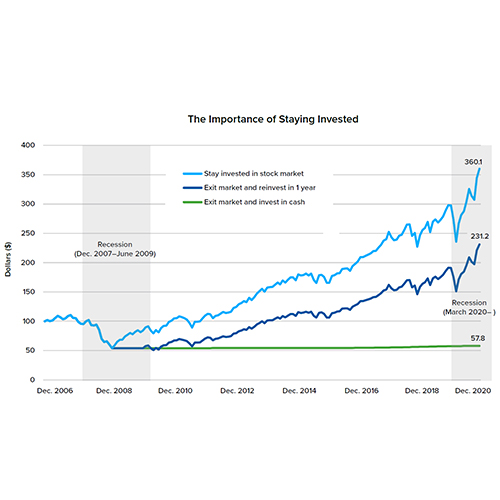

Selling during times of fear can cause investors to miss out on the sizable recoveries that have historically followed downturns. Those who stay invested tend to achieve higher returns over the long-term than those who cash out altogether or exit the market near its lowest point, only to reinvest a year later.1

To learn more about how Thomas Financial can help position your portfolio for the long run, please call us at (813) 273-9416 or email u directly at info@thomasfinancial.com.

Footnotes:

The image illustrates the value of a $100 investment in the stock market during the period 2006-2020. Data sources: Strategic Capital Investment Advisors. The market is represented by the Russell 3000 Index. Cash is represented by the 30-day U.S. Treasury bill. An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for taxes or transaction costs. This is for illustrative purposes only and not indicative of any investment. This information has been taken from sources, which we believe to be reliable, but there is no guarantee as to its accuracy. For index definitions, please visit http://mfinwealth.com/index.

Securities and Investment Advisory Services Offered Through M Holdings Securities, Inc. A Registered Broker/Dealer and Investment Advisor, Member FINRA/SIPC. Thomas Financial is independently owned and operated. CA Insurance License #0L02602. File #4741504.1