6 Key Employee Benefits Trends for 2023

Over the last few years, almost every aspect of the workplace has changed, leading to many unforeseen challenges. Current labor challenges are forcing employers to find ways to balance rising costs and inflation while providing employees with benefits they value and need. Understanding this year’s key employee benefits trends can help employers assess whether their offerings meet employee demands and needs so that they can attract and retain talent. This article discusses six key employee benefits trends for 2023.

What the SECURE 2.0 Act means for your business and employees

The common-sense solutions—including encouraging employers to offer more plan options and making it easier for small businesses to provide retirement savings plans—will help employees grow their retirement savings for the future.

401(k) Employee Education Seminar

Never Underestimate the Value of Employee Education and Engagement. With ongoing market volatility, participants increasingly seek advice around risk, performance, and fees associated with their plan’s investment options. At Thomas Financial, we deliver custom-made live and virtual participant education and communications programs. Here’s a brief clip of a virtual seminar.

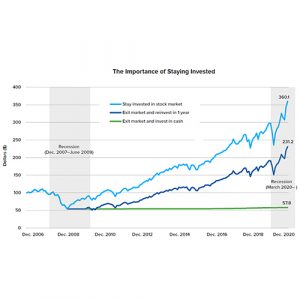

The Importance of Staying Invested

When markets are volatile, either up or down, it’s easy for investors to let emotions like euphoria or fear get the better of them, causing impulsive investment decisions.

Top 5 Tips to Stem the Rising Cost of Healthcare

With employer-sponsored healthcare costs expected to rise 7.6% in 2022, employee benefits are a significant investment for any size company. Thomas Financial is dedicated to saving employers time and money, while improving the benefits experience for their employees. Does your benefits advisor provide you with a comprehensive set of cost-controlling options? Check out our Top 5 Pro Tips to keep costs down.

Death and Taxes: Hard Lessons from Prince’s Lack of Estate Planning

Prince Died in 2016 Without a Will or Estate Plan. After six years, the IRS and the estate’s administrators finally agreed to an estate value of $156.4 million. An estate the size of Prince’s could incur up to $84.9 million in estate taxes, due within nine months of the final valuation. Life insurance is a cost-effective and efficient way to fund estate tax obligations for pennies on the dollar. If properly structured, the life insurance death benefit will not be subject to income tax or estate tax.

Holistic Financial Planning

Holistic financial planning is an ongoing process, defined and directed by your personal and financial needs and goals, as well as your values. We believe that by taking the time to identify your objectives, you are more likely to develop a sound and workable financial plan, which will enable you to achieve your most important aspirations in the future.

5 Universities That Use Split- Dollar Life Insurance to Recruit and Retain Top-Tier Coaches

The coaching carousel has never spun faster as we head into the College Football Bowl and Championship season. The recruiting and retention of coaches have been under full public display, particularly at some of the highest-profile athletic programs. So how do powerhouse universities recruit and retain top-tier coaches? Increasingly, it includes split-dollar life insurance as a key part of their compensation package.

Volatility is the new normal in today’s market.

We can fear it, or we can embrace it. A down market can be unsettling. Taking distributions during a decline can cause long-term damage to your portfolio, especially later in life. A downturn can also be an opportunity if your portfolio is designed to capture it.

Jay Adkisson

Wed. November 17 | 10am PT Asset protection is commonly used to mitigate the effects of future creditors, lawsuits, and other liabilities. Jay Adkisson, attorney and Managing Partner of Adkisson Pitet LLP, explores current planning trends and how life insurance can be an effective asset protection tool when used within trusts and advanced estate planning […]

Andy Friedman

Wed. November 11 | 10am PT Proposed changes to tax legislation could have significant market and economic impacts. In this special legislative session, Washington insider Andy Friedman discusses what proposed tax changes could mean for retirement investors and small business owners, and offer insights for year-end planning.

Ella Chase

Wed. September 29 | 10am PT Ella Chase, co-founder of Wellth Works and a sixth-generation inheritor within a family enterprise, uniquely understands the advisor-client relationship for HNW women. Ella will discuss tactical tools to improve advisor relationships with clients and their family members so that advisors can “stick with the family,” and she’ll address and […]

Tracy Brower

Wed. August 18 | 10am PT Join sociologist and author Dr. Tracy Brower for an engaging discussion about the future of work, leadership, and engagement and how to best motivate ourselves and employees. Dr. Brower will cover new research, surprising insights, and pragmatic approaches to cultivate and sustain resilience and success through the continuous changes […]

Thomas Financial Names Leslie Darrigo as a Firm Principal

Anyone who has done business with Thomas Financial knows Chief Operating Officer Leslie Darrigo as a fierce client advocate from the underwriting process until the final claim is paid. In recognition of her 37 years of service excellence with Thomas Financial, we are proud to announce her appointment as a Principal and Equity Partner.

Andy Friedman

Wed. June 23 | 10am PT Andy Friedman is known for his unique insight and analysis of the political landscape and prospective legislation. He will share his views on proposed tax changes and what this could mean for all facets of the financial industry.

Paul Sullivan

Wed. April 15 | 10am PT Paul Sullivan writes the Wealth Matters column for The New York Times covering issues from private banking and wealth management to philanthropy and inheritance. His articles have appeared in publications such as Fortune, Money, and The Financial Times.

Ian Bremmer

Wed. March 18 | 10am PT Join renowned political scientist Ian Bremmer for a trip around the world in 20 minutes. Ian unpacks the geopolitical landscape and its impact on the U.S. economy, climate issues, cybersecurity, and more. He shares why we should feel optimistic about the post-pandemic recovery, as well as the principal global […]

Jonathan Godsall

Wed. February 24 | 10am PT Jonathan Godsall provides data-driven insights into how the insurance industry is adapting to meet the expectations of the client of the future. Watch the replay to hear more about the trends reshaping the industry, the changing needs of consumers, and the importance of expanded and enhanced digital capabilities.

Andy Friedman

Wed. February 17 | 10am PT Andy Friedman provides a comprehensive review of the new Washington landscape and its potential effects on taxes and investing.

Paulo Pinho

Wed. January 27 | 10:00 am PT Dr. Paulo Pinho looks at why COVID-19 has caused challenges finding coverage for jumbo cases and older clients. Dr. Pinho discusses co-morbid conditions and how they exacerbate COVID-19, how reinsurers view COVID-19, the keys to success for the vaccines, and what has to happen before things return to […]

Kedra Newsom

Wed. October 28 | 10:00 am PT Kedra Newsom of Boston Consulting Group engaged the M Community in a robust discussion about women’s wealth and the complex needs of HNW and UHNW women. She shared specific strategies for advisors in this market and how the industry is changing to better reach this audience.

Paul Ryan

Wed. October 7 | 10:00 am PT M Financial was honored to welcome Paul Ryan, former Speaker of the U.S. House of Representatives, as our fall Future of Insurance keynote speaker. From his two decades in office to the founding of the nonprofit American Idea Foundation, Paul Ryan’s career has focused on public policy and […]

Carrier Discussion

Wed. September 23 | 10:00 am PT Henry Wong & Tod Nasser – John Hancock & Pacific Life Wondering how the current state of the economy and capital markets are impacting carrier portfolios and investments, and what that means for new business? Tod Nasser of Pacific Life and Henry Wong from John Hancock engaged in a panel discussion […]

Don Delf

Wed. September 9 | 10:00 am PT Don Delf, Private Wealth Advisory Leader for PwC US, brought his legacy and expertise in private wealth to answer the trillion-dollar question: What’s top of mind for business owners and family offices heading into elections and uncertainty? Don also explored how elasticity of exemptions is critical in the […]

Tony Arnerich

Wed. August 12 | 10:00 am PT Multi-Impact Asset Management in the Current Economy Tony Arnerich explored current trends related to ESG (environmental, social, governance) investing, intentional investing, and wealth transfer to the next generation. He demonstrated how the pandemic has created opportunities for environmentally and socially responsible investing and the implications to your clients’ […]

Scott Clemons

Wed. July 29 | 10:00 am PT Investing in the Wake of a Pandemic Scott Clemons, Chief Investment Strategist for Brown Brothers Harriman, examined the data around the pandemic’s effects on the economy. He also discussed the impact for insurance companies managing large amounts of money, what it means for your clients’ portfolios, and the […]

Zanny Beddoes

Wed. July 15 | 10:00 am PT Our Global Economy in the Post-Pandemic World KEYNOTE SPEAKER: Zanny Minton Beddoes – The Economist Named one of the Most Powerful Women in the World by Forbes, Zanny Minton Beddoes is a leading voice at the intersection of economics and policy. Known for delivering sophisticated insight on all facets of […]

Marc Cadin and Armstrong Robinson

Wed. June 24 | 12:30 PT COVID = Accelerant for Change AALU/GAMA’s Marc Cadin and Armstrong Robinson examined developing political trends and what financial professionals should expect through election day. They also explored the long-term impact of recent regulatory and legislative actions and identified the top opportunities and threats these regulations will generate for financial […]

Marc-Andre Giguere

Wed. June 17 | 11:00 am PT What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current market conditions? Marc-Andre Giguere discussed possible ripple effects […]

Doug French

Wed. June 3 | 10:00 am PT Beyond COVID 19 – How the insurance industry will reimagine their business. Doug French, Ernst & Young’s Managing Principal of Insurance & Actuarial Services, examined the current economic disruption, its impact on the global insurance marketplace, and the effects on wealth transfer for the UHNW client, followed by […]

Colin Devine

Wed. June 3 | 10:00 am PT Outlook for the U.S. Life Insurance Industry After COVID-19 Colin Devine, Principal of C. Devine & Associates, examined the current status of the U.S. life insurance industry and how life insurers are doing amid COVID-19. Colin offers deep insights into what to expect in the coming months, the new […]

Dr. Quincy Krosby

Wed. May 6 | 10:00 am PT Of the Moment Market Outlook Dr. Quincy Krosby, Prudential’s Chief Market Strategist, discussed how the pandemic is impacting financial markets and the overall economy. Dr. Krosby explored the recent and rapid shift in consumer behavior and the emergence of new technologies for navigating the current landscape, and she […]

Jeff Bush

Wed. April 22 | 9:30 am PT An Overview of the Political Environment, Prospective Legislation, and Strategies for Investment and Retirement Planning Jeff Bush and Andy Friedman have collaborated on a 2020 presentation that addresses all of the issues brought about by the recent coronavirus pandemic. In his April 22 presentation, Jeff explored the details […]