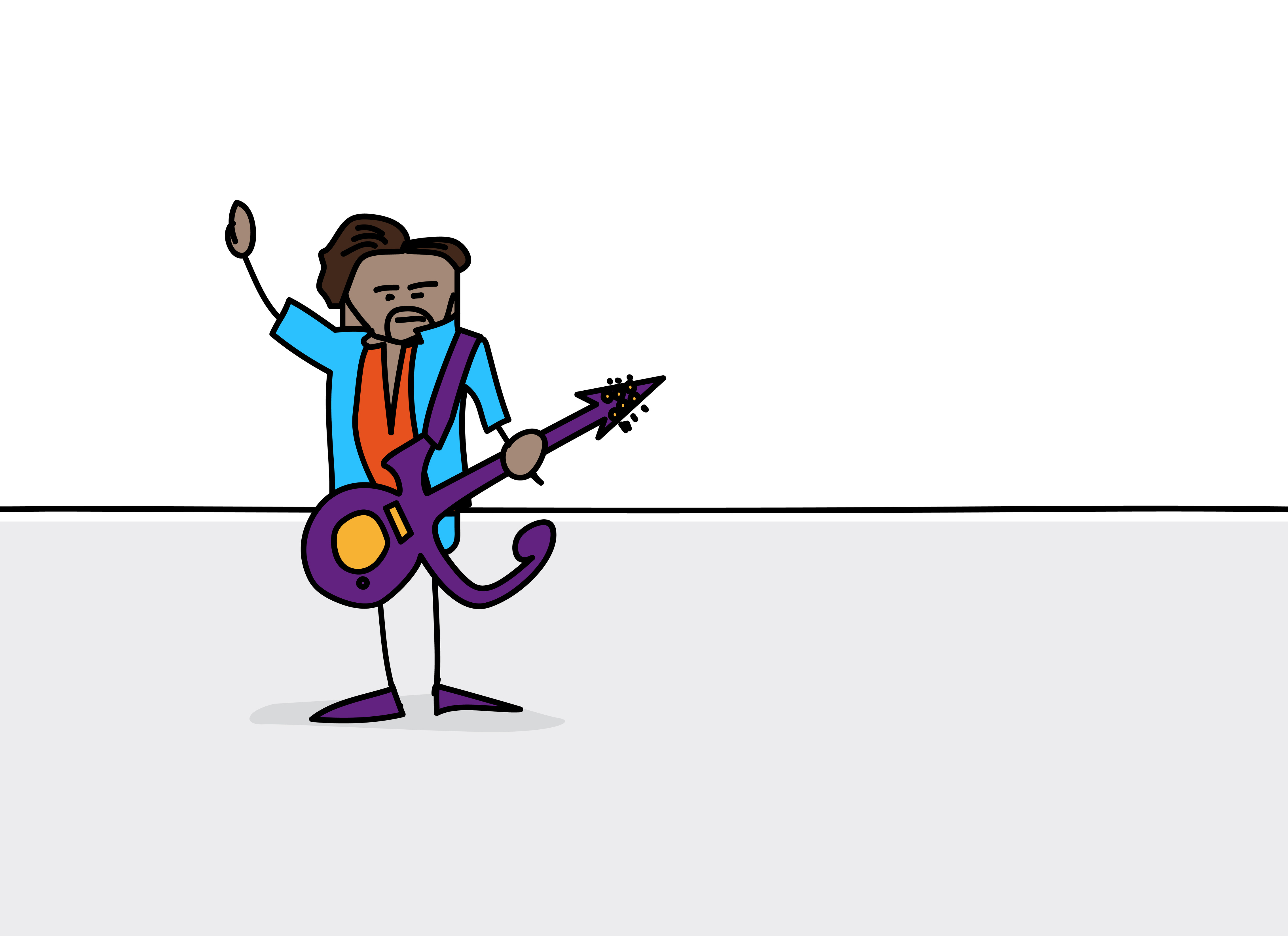

Prince Died in 2016 Without a Will or Estate Plan

Initially, his estate was valued at $82.3 million, including 12 properties, fine art, a secret “vault” of unreleased music, rights to his published music, and financial interests in four companies.

After six years, the IRS and the estate’s administrators finally agreed to an estate value of $156.4 million.

Just over $5 million will be exempted from federal taxes, and after that, the tax rate is 40 percent. There is an additional 16% estate tax in Minnesota at death.

An estate the size of Prince’s could incur up to $84.9 million in estate taxes, due within nine months of the final valuation.1

Paying Large Estate Taxes

If there are sufficient liquid assets and cash in the estate, they can be used to pay the taxes. If not, the resulting distressed “fire sale” of assets could result in discounted prices and destruction of value for the heirs.

Life insurance is a cost-effective and efficient way to fund estate tax obligations for pennies on the dollar.If properly structured, the life insurance death benefit will not be subject to income tax or estate tax.2

Leveraging an Irrevocable Life Insurance Trust

One very effective strategy to reduce the cost of meeting estate tax obligations is the use of an Irrevocable Life Insurance Trust (ILIT) to purchase life insurance outside of the estate.

Here’s how it works:

By using this technique, the insured not only removes the gifted assets from the estate but creates a plan for their heirs that provides an income- and estate-tax free pool of money to pay the estate taxes.